You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Is There a New Dotcom Bubble?

- Thread starter Juan

- Start date

More options

Who Replied?- Dec 15, 2016

- 4,664

- Tinnitus Since

- 08/2014

- Cause of Tinnitus

- Several causes

The guy made up a Twitter poll just to get rid of his shares:

Elon Musk sells $5bn in Tesla stock days after Twitter poll

Billionaire offloads around 3% of his holding – though £1bn was already in train before he asked Twitter users about reducing his stake

https://www.theguardian.com/technol...ock-but-was-it-really-because-of-twitter-poll

Elon Musk sells $5bn in Tesla stock days after Twitter poll

Billionaire offloads around 3% of his holding – though £1bn was already in train before he asked Twitter users about reducing his stake

https://www.theguardian.com/technol...ock-but-was-it-really-because-of-twitter-poll

I think it's higher than that. The official figures always underplay the reality. If you track the rise in price of essential assets, it's north of 10%.US inflation at 6,2% and those idiots from the FED keep interest rates at zero. The US economy will go down the drain... it's no surprise Warren Buffett's cash pile is increasing by the day. He won't buy into an overpriced, bubble market.

I just saw this interview today and Max Keiser literally reiterates everything I've been saying. People have no idea have fragile this situation is.

Watch it all, or if you're pressed for time, watch from 3 minutes and 6 minutes in. This is someone who is actually on the money, pardon the pun.

- Dec 15, 2016

- 4,664

- Tinnitus Since

- 08/2014

- Cause of Tinnitus

- Several causes

We are all perfectly aware of the situation.I just saw this interview today and Max Keiser literally reiterates everything I've been saying. People have no idea have fragile this situation is.

The situation will not change unless central bankers do their jobs, which they are neglecting and refusing to do.

Their job consists of RAISING the interest rates in a context of rampant inflation.

Their job consists of RAISING the interest rates in a context of rampant inflation.

Why do you think they haven't done this already? It wasn't long ago that they were talking about making the rates negative. I agree with Max that the dollar should be downgraded because the fiat experiment has gone wrong. Raising the rates now would collapse the economy. You need a heathy GDP to debt ratio for this to be safe, and right now, the economy is on its knees.

Watch all of the interview. He makes a lot of valid points.

- Dec 15, 2016

- 4,664

- Tinnitus Since

- 08/2014

- Cause of Tinnitus

- Several causes

I do not agree with that. People and companies have been borrowing money at fixed rates, so increasing interest rates will not have such a big effect, and would contain inflation. Norway has raised rates. New Zealand, Russia, the Czech Republic, have also raised interest rates.Raising the rates now would collapse the economy. You need a heathy GDP to debt ratio for this to be safe, and right now, the economy is on its knees.

If they can do it the FED and the ECB can raise rates too.

American billionaires are hiding a pile of money in tax havens. The answer to the current economic crisis is simply make them pay taxes like anyone else.

You have just proved my point. They are some of the least indebted countries, and Russia has one of the best GDP to debt ratios in the world. In fact, there are only about 4 countries that are better off than Russia.I do not agree with that. People and companies have been borrowing money at fixed rates, so increasing interest rates will not have such a big effect, and would contain inflation. Norway has raised rates. New Zealand, Russia, the Czech Republic, have also raised interest rates.

If they can do it the FED and the ECB can raise rates too.

American billionaires are hiding a pile of money in tax havens. The answer to the current economic crisis is simply make them pay taxes like anyone else.

Norway raised their rates by 0.25%; New Zealand raised theirs by 0.25%, and the Czech Republic was 2.5% over the course of this year.

Their Debt to GDP ratios are (lower is better):

Norway 36.75%

The Czech Republic 31.57%

New Zealand 30.10%

Russia 19.48%

By comparison:

USA 137%

Spain 122.8%

UK 103.6%

You'll notice that any country that raises its rates (in this economic climate) will have a good debt to GDP ratio. This means they can afford to. The USA would cripple its economy and they know this, which is why they haven't yet done so. They are massively over-leveraged, and the worst thing you can do to an underperforming economy is raise the rates. As I said before, normally a central bank would lower rates in these circumstances which is why there was talk of going into the negative. They are buying back their own debt and are still printing tens of billions each month because they no longer have a solution. Their options are: raise the rates enough to contain inflation and kill the economy, or, lower the rates and/or keep printing tons of money and watch as runaway inflation takes over. They will likely have to default at some point as I can't see how they can sustain their lunacy. In reality, their bonds should be derated by Moody's to a CCC rating, but they have retained their AAA status as far as I'm aware.

Does anyone remember the subprime mortgage fiasco? All those MBSes, CDOs, and bonds were rated AAA as well (even though we now know they were worthless junk). I honestly think some of these traditional financiers live in cloud cuckoo land as their views and reality do not go hand in hand.

- Dec 15, 2016

- 4,664

- Tinnitus Since

- 08/2014

- Cause of Tinnitus

- Several causes

The digital newspaper library (2010):

Google on 'Spy-Fi': We failed badly

https://thehill.com/policy/technology/125471-google-on-qspy-fiq-we-failed-badly

And they keep stealing data... and failing also... to pay taxes.

Google on 'Spy-Fi': We failed badly

https://thehill.com/policy/technology/125471-google-on-qspy-fiq-we-failed-badly

And they keep stealing data... and failing also... to pay taxes.

I forgot to add that the ECB is also trapped. Some of the countries that use the Euro are so heavily indebted that they cannot survive on their own. Italy has a GDP to debt ratio of 155%. The ECB also bought over 3 trillion worth of debt earlier this year. The situation is snowballing.

They will all try and copy Japan and run up their debts into the heavens whilst trying not to default. Japan has something like a 257% GDP to debt ratio. It's bonkers. That's nearly 3 times bigger than the size of its entire economy. A country could theoretically run at 0% for the rest of time as long as people don't lose faith in the currency, and judging from people's general comments and opinions over the internet (when it comes to money), the average person has little to no understanding of how fiat works.

The challenge for the FED and the ECB is to not default. They'll take inflation over a collapse, but it's how they manage to contain it in the coming years that will be crucial. Everyone should expect a rocky road ahead (which is why I got exposure to crypto in the first place). Everyone instinctively believes that their national currency is infallible, that is until they end up like Zimbabwe and are taking suitcases full of money to the store just to buy a loaf of bread.

They will all try and copy Japan and run up their debts into the heavens whilst trying not to default. Japan has something like a 257% GDP to debt ratio. It's bonkers. That's nearly 3 times bigger than the size of its entire economy. A country could theoretically run at 0% for the rest of time as long as people don't lose faith in the currency, and judging from people's general comments and opinions over the internet (when it comes to money), the average person has little to no understanding of how fiat works.

The challenge for the FED and the ECB is to not default. They'll take inflation over a collapse, but it's how they manage to contain it in the coming years that will be crucial. Everyone should expect a rocky road ahead (which is why I got exposure to crypto in the first place). Everyone instinctively believes that their national currency is infallible, that is until they end up like Zimbabwe and are taking suitcases full of money to the store just to buy a loaf of bread.

- Dec 15, 2016

- 4,664

- Tinnitus Since

- 08/2014

- Cause of Tinnitus

- Several causes

I do not see the US economy underperforming at all.and the worst thing you can do to an underperforming economy is raise the rates.

And central banks had years to raise rates in a context of economic growth prior to COVID-19.

I think there is going to be another Subprime Fiasco in the US. The FED will stop fuelling the secondary mortgage market. In 9 months they will not be buying...Does anyone remember the subprime mortgage fiasco? All those MBSes, CDOs, and bonds were rated AAA as well (even though we now know they were worthless junk). I honestly think some of these traditional financiers live in cloud cuckoo land as their views and reality do not go hand in hand.

- Feb 25, 2021

- 1,133

- Tinnitus Since

- 01/2020

- Cause of Tinnitus

- Noise

A big problem with raising the interest rates when the big countries don't follow, is trade deficit I think it's called. Our already strangled industries will not cope well.You have just proved my point. They are some of the least indebted countries, and Russia has one of the best GDP to debt ratios in the world. In fact, there are only about 4 countries that are better off than Russia.

Norway raised their rates by 0.25%; New Zealand raised theirs by 0.25%, and the Czech Republic was 2.5% over the course of this year.

Their Debt to GDP ratios are (lower is better):

Norway 36.75%

The Czech Republic 31.57%

New Zealand 30.10%

Russia 19.48%

By comparison:

USA 137%

Spain 122.8%

UK 103.6%

You'll notice that any country that raises its rates (in this economic climate) will have a good debt to GDP ratio. This means they can afford to. The USA would cripple its economy and they know this, which is why they haven't yet done so. They are massively over-leveraged, and the worst thing you can do to an underperforming economy is raise the rates. As I said before, normally a central bank would lower rates in these circumstances which is why there was talk of going into the negative. They are buying back their own debt and are still printing tens of billions each month because they no longer have a solution. Their options are: raise the rates enough to contain inflation and kill the economy, or, lower the rates and/or keep printing tons of money and watch as runaway inflation takes over. They will likely have to default at some point as I can't see how they can sustain their lunacy. In reality, their bonds should be derated by Moody's to a CCC rating, but they have retained their AAA status as far as I'm aware.

Does anyone remember the subprime mortgage fiasco? All those MBSes, CDOs, and bonds were rated AAA as well (even though we now know they were worthless junk). I honestly think some of these traditional financiers live in cloud cuckoo land as their views and reality do not go hand in hand.

So my guess is the rate in Norway will only go up an additional 0.75 % if the big guns don't follow soon.

The USA has the largest economy, but they are massively over-leveraged.I do not see the US economy underperforming at all.

As already stated, their GDP to debt ratio is out of control and they've been running a deficit for years.

This is by far the largest their debt has ever been, adjusted for inflation. In 1800, their debt was around $82m; adjusted for inflation that is $1.8b in today's money. In 1900 their total debt was around $2b; adjusted for inflation that's around $65b in today's money. Right now, their debt is over $28t and rising.

A study by the world bank in 2013 found that if a country has sustained debt-to-GDP of more than 77% it slows economic growth. The USA has had a ratio greater than 100% for years.

This is why central banks are on borrowed time.And central banks had years to raise rates in a context of economic growth prior to COVID-19.

- Dec 15, 2016

- 4,664

- Tinnitus Since

- 08/2014

- Cause of Tinnitus

- Several causes

@Ed209, I think the economic pain is unavoidable, so the sooner central banks react the better.

The last inflation data for the US was like a slap in the face for the FED. They expected and forecasted 5,8% thinking it would be lower, thinking inflation would fall way short of that.. and their cooked data showed... 6,2%!!!

And everyone knows inflation is greater than 6,2% in the US.

Then the US goes to this climate change conferences and fails to acknowledge that its citizens are the most polluting beings on Earth, every American consuming and polluting like hundreds of people from other countries...

I dont really see how the US economy can continue doing the same shit without adjusting the current model.

Big Tech, crypto etc will eventually be regulated as well, and that will be another source of pain. Europe is failing to take the right steps to regulate those fields too, technology and crypto, the only reason for this being that EU politicians have been buttered and bought by those American companies.

The last inflation data for the US was like a slap in the face for the FED. They expected and forecasted 5,8% thinking it would be lower, thinking inflation would fall way short of that.. and their cooked data showed... 6,2%!!!

And everyone knows inflation is greater than 6,2% in the US.

Then the US goes to this climate change conferences and fails to acknowledge that its citizens are the most polluting beings on Earth, every American consuming and polluting like hundreds of people from other countries...

I dont really see how the US economy can continue doing the same shit without adjusting the current model.

Big Tech, crypto etc will eventually be regulated as well, and that will be another source of pain. Europe is failing to take the right steps to regulate those fields too, technology and crypto, the only reason for this being that EU politicians have been buttered and bought by those American companies.

What I like about crypto is that there's an honesty and an integrity to it that doesn't require men in suits to mess with it. I've been using it for over 18 months for both banking-type services and card-driven spending services and it beats the banks hands down. However, as with most things, I'm sure humanity will find a way to fuck it all up and ruin it.@Ed209, I think the economic pain is unavoidable, so the sooner central banks react the better.

The last inflation data for the US was like a slap in the face for the FED. They expected and forecasted 5,8% thinking it would be lower, thinking inflation would fall way short of that.. and their cooked data showed... 6,2%!!!

And everyone knows inflation is greater than 6,2% in the US.

Then the US goes to this climate change conferences and fails to acknowledge that its citizens are the most polluting beings on Earth, every American consuming and polluting like hundreds of people from other countries...

I don't really see how the US economy can continue doing the same shit without adjusting the current model.

Big Tech, crypto etc will eventually be regulated as well, and that will be another source of pain. Europe is failing to take the right steps to regulate those fields too, technology and crypto, the only reason for this being that EU politicians have been buttered and bought by those American companies.

Various crypto projects have the capability to change the financial world and beyond. As the world has advanced, banks have barely changed, and this lack of innovation on their part is now catching up with them. They became too lazy and too greedy.

I don't think the general public at large really understand what the good crypto projects are all about and what they are capable of, as their scope extends way beyond just being a new monetary system. The media tends to write stories about the meme coins and the scams more than anything else, and this gives the entire industry a bad name because the average Joe is not going to look any further.

The vast majority of the coins on the market will go to zero. That's a fact, but that doesn't stop the pioneers in this field from doing truly groundbreaking work, and that's where the real beauty lies.

- Dec 15, 2016

- 4,664

- Tinnitus Since

- 08/2014

- Cause of Tinnitus

- Several causes

Banks cannot change because they are heavily regulated.As the world has advanced, banks have barely changed, and this lack of innovation on their part is now catching up with them.

Crypto will be regulated as well.

Big tech is barely regulated and that's exactly what's fucking up our world today. Predatory companies who steal data, invade privacy and do not pay their taxes.

That's obvious, and it's already happening. At least they can't mess around with the supply, and smart contracts will improve a lot of things.Crypto will be regulated as well.

That's not true. They can innovate and change all they want. They just never bothered.Banks cannot change because they are heavily regulated.

It's only now, after the rise of crypto, that they are all scrambling to create CBDCs.

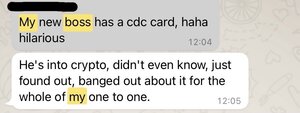

Talking about banks, one of my close friends (who I've known since school) works for a bank, and he is part of our investment group chat. He gives some insight into what the banks are talking about behind the scenes in board meetings and such. It's quite interesting how in the early days he said they were completely dismissive of crypto, even mocking it, and now they're at the point where his boss has a crypto card himself, and he writes a blog about it! A complete 180 reversal.

I've blanked out names, but I thought I'd share some of the things we've discussed as it's very revealing:

This was written a while ago, so you can see what the sentiment was like.

Fast forward a while and you can see how the sentiment is changing at the corporate level. In the first message he's saying how his then anti-crypyo boss now has a crypto card and writes blogs about it Then he says his new boss has one as well.

Then he says his new boss has one as well.

PS: I'm not involved in the discussions I've posted. It's between my friends.

I've blanked out names, but I thought I'd share some of the things we've discussed as it's very revealing:

This was written a while ago, so you can see what the sentiment was like.

Fast forward a while and you can see how the sentiment is changing at the corporate level. In the first message he's saying how his then anti-crypyo boss now has a crypto card and writes blogs about it

Then he says his new boss has one as well.

Then he says his new boss has one as well.PS: I'm not involved in the discussions I've posted. It's between my friends.

Attachments

- Dec 15, 2016

- 4,664

- Tinnitus Since

- 08/2014

- Cause of Tinnitus

- Several causes

They cannot innovate if they are subject to tons of regulations.That's not true. They can innovate and change all they want. They just never bothered.

Revolut has a sort of banking licence that works for the EU, issued, if my memory serves well, in Lithuania. However, they are not subject to exactly the same rules and regulations that apply to the old banks.

They can innovate as there's nothing in the regulations to stop them, and let's face it, they write the regulations anyway. Their systems are slow and cumbersome because they never bothered to update the infrastructure. It's now coming back to bite them in ass as they scramble to make up lost ground.They cannot innovate if they are subject to tons of regulations.

Revolut has a sort of banking licence that works for the EU, issued, if my memory serves well, in Lithuania. However, they are not subject to exactly the same rules and regulations that apply to the old banks.

Sophie and Leda explore what it does, and will, take to upgrade the banking infrastructure of some of the world's largest and oldest banks. They look at why large incumbent banks are where they are, how to overcome the complications they face in moving towards a digital future, and what it takes to make that decision - to essentially take the beating heart out of your bank while keeping the blood pumping.

"Banks have started waking up to what could be done. What should be done. And now, it is much easier to build the infrastructure to accelerate those ambitions."

What are the challenges of legacy banking infrastructure?

Knowing the problem you're solving from the inside, equips you to solve it better. Many within 10x have spent years working inside banks and that experience has been valuable in the transition to the technology side. You know what problem you've solving, but you also know why it is the way it is. The reality is that banks have uneven technical landscapes. It's not accurate to say all banking technology is aged. But it is fair to say that quite a lot of it is. Having such a variety in technology maturity is as much a problem.

"Banks have started waking up to what could be done. What should be done. And now, it is much easier to build the infrastructure to accelerate those ambitions."

What are the challenges of legacy banking infrastructure?

Knowing the problem you're solving from the inside, equips you to solve it better. Many within 10x have spent years working inside banks and that experience has been valuable in the transition to the technology side. You know what problem you've solving, but you also know why it is the way it is. The reality is that banks have uneven technical landscapes. It's not accurate to say all banking technology is aged. But it is fair to say that quite a lot of it is. Having such a variety in technology maturity is as much a problem.

Everybody knows how poor the traditional banking infrastructure is. It's common knowledge.

I believe people should be taught economics at school. The average persons understanding of money is abysmal, so it's no wonder people don't understand why they are getting poorer whilst all the assets around them are becoming more expensive. Since the world switched to fiat, wages haven't increased in any meaningful way, but everything else has become more expensive. Money has been debased which is why many people can no longer afford things like houses. Central banks have been expanding their balance sheets by about 15% each year, which means we've all been getting poorer by 15% every year because wages haven't increased by anywhere near that much. There is a huge gap that is getting bigger. Even if wages went up by 3%, we'd still be 12% worse off.

Then people put their money into savings accounts with banks, but what's the point? You don't earn anything, and certainly not enough to cover the ever expanding money supply which is debasing those savings over time anyway. You can't win like that.

Crypto is scaring the life out of banks and governments across the world because it offers people a way out of poverty, but it comes at the cost of governments losing power. I don't believe they will ban it because it will cause a revolt. Instead, they will regulate it and use it in a way which benefits them also.

- Dec 15, 2016

- 4,664

- Tinnitus Since

- 08/2014

- Cause of Tinnitus

- Several causes

I think it is rather Big Tech who writes the regulation today, with hundreds of people who transition from Google to the US government and vice versa. The only possible exception to this is Goldman Sachs, which has an influence comparable to that of Big Tech, but this is quite an exception among banks, let alone traditional banking.They can innovate as there's nothing in the regulations to stop them, and let's face it, they write the regulations anyway.

So let's go out and demonstrate. Or buy FAANG until governments regulate it and make those companies pay taxes, or people grow so sick of them that do not bother engaging with those tech companies anymore.Central banks have been expanding their balance sheets by about 15% each year, which means we've all been getting poorer by 15% every year because wages haven't increased by anywhere near that much.

In the 90s, during a period of particularly high unemployment in Spain a group of demonstrators set fire to one of the Regional Parliament buildings. And then things changed. So it seems demonstrating works.

Remember the French Gillet Jaunes, who forced the French government to take back the proposed extended date of retirement. Demonstrating works.

Yes, that is the aim to replace fiat with Crypto and outlaw "alternative" crypto.Banks cannot change because they are heavily regulated.

Crypto will be regulated as well.

Big tech is barely regulated and that's exactly what's fucking up our world today. Predatory companies who steal data, invade privacy and do not pay their taxes.

Even if clowns laugh at that, any reasonable person can sense that development.

CBDC's are not cryptocurrencies. They would be a fully digitalised version of what we have now, but in a restructured way that gives the controlling banks more political power. It would completely remove privacy as well, as every single transaction would be tracked by the government.Yes, that is the aim to replace fiat with Crypto and outlaw "alternative" crypto.

Even if clowns laugh at that, any reasonable person can sense that development.

The US economy is slowing down, and this is what's creating the problem for the FED. Their experiment of handing everybody money has ultimately failed because it has led to inflation that can be seen on the CPI:

This means that people can now see that their money is not worth as much. It's like having a pay decrease at work. To reverse this they have to raise the rates, but they are scared to do this because of how the economy is in a downturn. It puts them in an impossible situation. They will continue tapering, but what they are doing now is peanuts.

People are moving their money into gold, Bitcoin, and other cryptos as a hedge. They are looking for safe havens to avoid the oncoming shitstorm.

What will they do about Bitcoin is the question? The problem for the government is that it is intrinsically linked to the internet, and the only way to really stop it, is to shut the internet down. They will regulate and tax it - that's already happening - but if there's a mass exodus out of fiat as people run for the hills, then what?

There's a real divide here. Some think that Bitcoin should become the new global standard, and others don't.

There are no conspiracies here, though. All relevant information is in the public domain. They do not have a "secret crypto" lined up. Although, Miami are already using their own Miamicoin via CityCoins, which is funding projects in their city. The Mayor-Elect of New York, Eric Adams, wants to follow suit and create a New York coin as well. He also wants to remove the current bureaucracy surrounding cryptocurrencies in New York.

Anyway, I think I've talked this topic to death now.

One last point:

Crypto DeFi could ultimately reset the financial system in favour of the masses, but that would not happen overnight, if it did at all. However, the fiat central bankers will throw everything they can at the crypto market in an attempt to destroy it.

- Dec 15, 2016

- 4,664

- Tinnitus Since

- 08/2014

- Cause of Tinnitus

- Several causes

If central banks come to their senses and raise the interest rates, there will be a lot of pain for crypto holders.Yes, that is the aim to replace fiat with Crypto and outlaw "alternative" crypto.

Even if clowns laugh at that, any reasonable person can sense that development.

Maybe but remember, they want people using crypto right now.If central banks come to their senses and raise the interest rates, there will be a lot of pain for crypto holders.

Why, you ask, right? There is often backlash against using crypto or warnings by the government or banks. So, why both still WANT you to use it?!? (I'm sure you're asking).

Well, I already explained it despite one poster's uninformed reaction.

They ARE replacing fiat money, the dollar, with their own issued crypto. Look at media reports from Sweden: getting rid of the kronor eventually.

The government wants citizens to have experience and familiarity with Crypto so the transition will be smoother. Of course, it will be different than what most are used to - it needs to be simplified so even the dumbest sheep can use it (obviously).

The point here, is it will be regulated and the pros/advantages that we have now with it, will be GONE.

They are massively over-leveraged, though, Juan. I don't think you understand how dire the situation is. The USA, the UK, and the EU are all in a terrible position. They are all above 100% debt-to-GDP (some countries are way above), and they are still monetising debt. They need to try and get below 60%; the USA is more than double this! It's crazy. At the same time, their economy is slowing down. If it was so easy to solve the dilemma they've got themselves into, they'd have raised the rates a while ago. Why do you think they haven't done this already?If central banks come to their senses and raise the interest rates, there will be a lot of pain for crypto holders.

Paul Volcker raised the rates to 20% in 1980 to counteract runaway inflation (which is where we are now). They took drastic measures because they could afford to; look at the USA's debt-to-GDP at the time:

They called this the Volcker shock, and it worked. Do you think they can afford to do that now with a debt-to-GDP of 137%? The UK also had interest rates of 17% in 1979 for the same reason.

If they did that now, they'd cripple the economy. People can't afford mortgages at 1%, so what do you think would happen if the banks started charging 10% and above for mortgages? What do you think would happen to businesses? The knock-on effect of businesses going bust is people losing their jobs.

It hasn't even gotten started yet, and there's the potential for a much fairer system. I'm not sure why everyone is so pro-bank here after all the shit they've caused, but each to their own I guess. It also helps if people understand how crypto works before criticising it because it's obvious that most of you don't.there will be a lot of pain for crypto holders.

This isn't true, either. They want to issue CBDC's; we've already been over this. CBDC's allow for a centrally controlled system (which is what governments want). If they released a truly decentralised crypto of their own then it would be no different to what's out there now.Well, I already explained it despite one poster's uninformed reaction.

They ARE replacing fiat money, the dollar, with their own issued crypto. Look at media reports from Sweden: getting rid of the kronor eventually.

So if that is the case, then let them.

- Dec 15, 2016

- 4,664

- Tinnitus Since

- 08/2014

- Cause of Tinnitus

- Several causes

I honestly do not understand why governments do not raise rates. Most of the debt issued during the last 10 years is at fixed rates, so whatever the interest rates are in the future that debt will not be affected. Mortgage holders, people who took up fixed-rate mortgages in the last 7 years approximately will not be affected either.They are massively over-leveraged, though, Juan. I don't think you understand how dire the situation is. The USA, the UK, and the EU are all in a terrible position. They are all above 100% debt-to-GDP (some countries are way above), and they are still monetising debt. They need to try and get below 60%; the USA is more than double this! It's crazy. At the same time, their economy is slowing down. If it was so easy to solve the dilemma they've got themselves into, they'd have raised the rates a while ago. Why do you think they haven't done this already?

Paul Volcker raised the rates to 20% in 1980 to counteract runaway inflation (which is where we are now). They took drastic measures because they could afford to; look at the USA's debt-to-GDP at the time:

View attachment 47713

They called this the Volcker shock, and it worked. Do you think they can afford to do that now with a debt-to-GDP of 137%? The UK also had interest rates of 17% in 1979 for the same reason.

If they did that now, they'd cripple the economy. People can't afford mortgages at 1%, so what do you think would happen if the banks started charging 10% and above for mortgages? What do you think would happen to businesses? The knock-on effect of businesses going bust is people losing their jobs.

The truth is central banks are financing Big Tech for free and allowed this companies to grow, producing losses every year, at the expense of other businesses that do pay taxes. It makes no sense perpetuating this model anymore.

And it makes no sense that the main beneficiaries of this rigged system (Big Tech) do not pay taxes and no one, not a single government or institution, does anything about it.

Actually those statement in favour of a global corporate tax around 15% are just nonsense... because it is all to be phased in by... 2030!!!! In almost 10 years! It's a fucking joke.

- Dec 15, 2016

- 4,664

- Tinnitus Since

- 08/2014

- Cause of Tinnitus

- Several causes

The Swiss are very fond of their cash, not even money in the bank but the good old pile of bills. That's the true freedom. Everything else is monitored and controlled.The government wants citizens to have experience and familiarity with Crypto so the transition will be smoother. Of course, it will be different than what most are used to - it needs to be simplified so even the dumbest sheep can use it (obviously).

Bitcoin was sponsored by the Winklevoss brothers, which were partners with that sinister Zuckerberg when he started Facebook. Then there was the legal battle etc... and these guys turned to crypto.

Let's use the old common sense: when someone is peddling something to you non-stop, advertising it 24/7, it's because they are selling you shit, or trying to take your money, and this is exactly what is happening with crypto.

When the real estate market collapsed no one told me "go buy property" but I did. Institutions, rich people, banks, do not come around to give you money for free or to offer you great investments. When they advertise or promote something is only for THEIR profit.

Member

Member